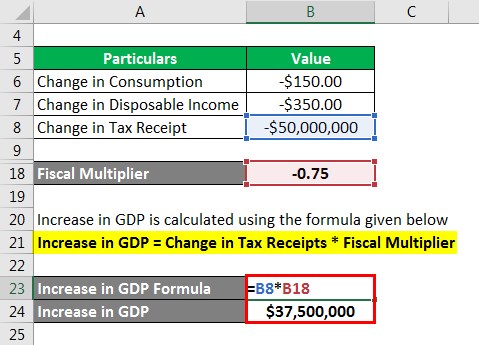

Tax multiplier calculator

Unemployment Rate The ratio of unemployed people to total people in the workforce. However in this calculator net profit does not include tax withholdings.

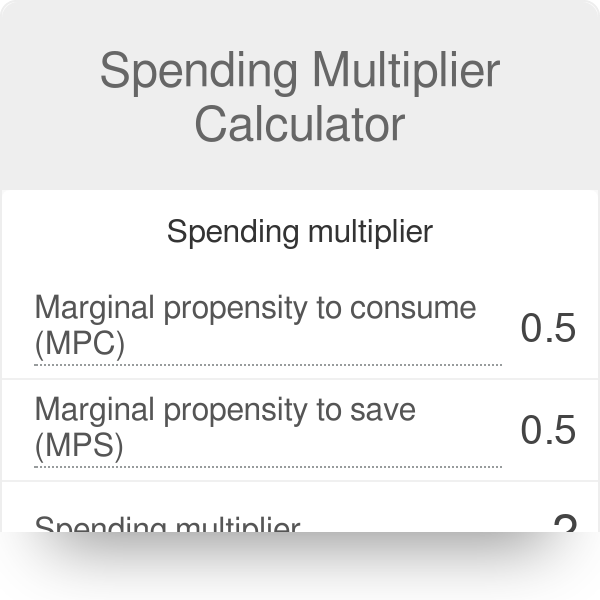

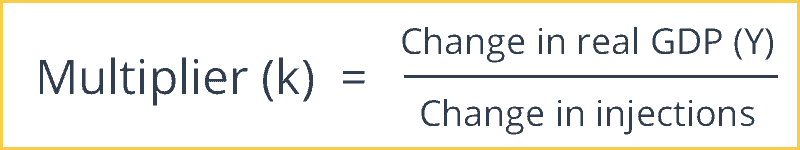

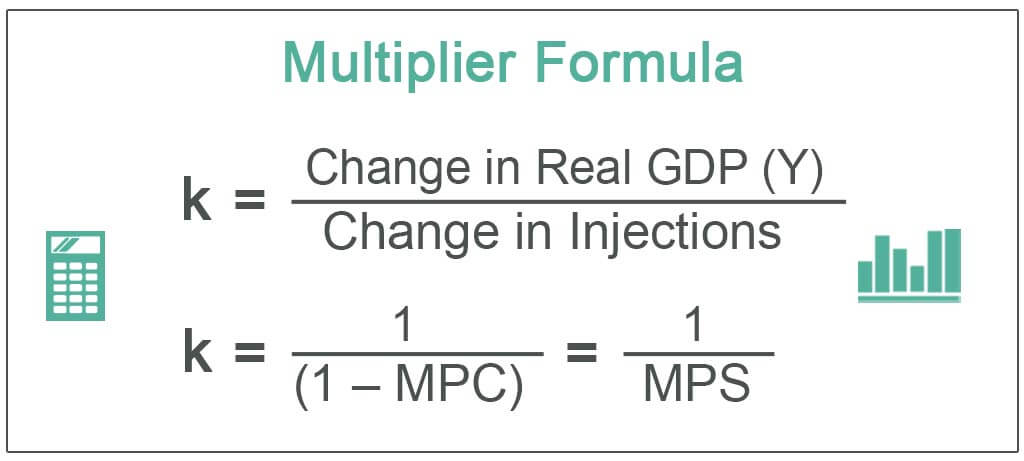

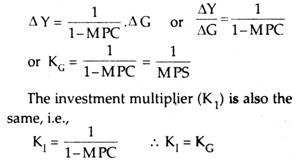

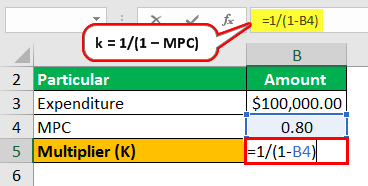

Spending Multiplier Calculator Formula

How much of my social security benefit may be taxed.

. Pick a number between 2 and 4. Percentage of Ownership Estimated Real Property Transfer Tax The value above is an estimate only. Check the table to find out which multiplier to use.

What is the Tax Multiplier Formula. Pay with MyToronto Pay Property Tax Lookup View your. Then the State Equalization FactorMultiplier State Equalizer is applied to the assessed value and this creates the Equalized Assessed Value EAV for the property.

In either case the multiplier is limited to 75 by law. Lets say youve already spent your settlement by the time tax season comes along. 2022 tax refund.

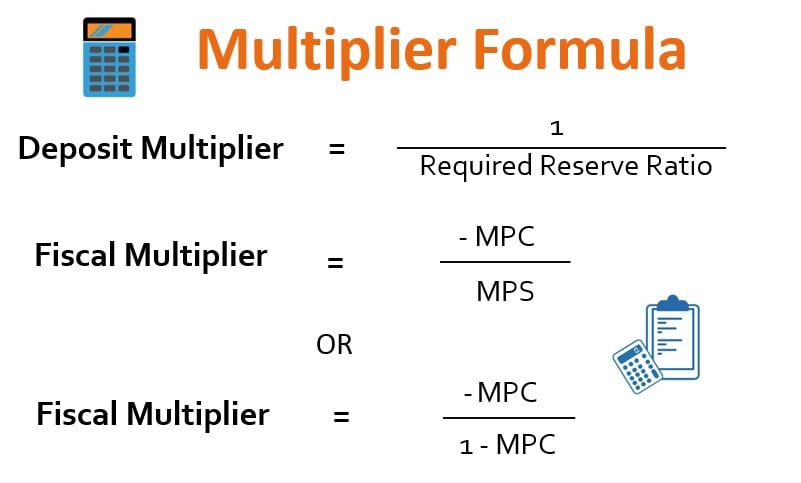

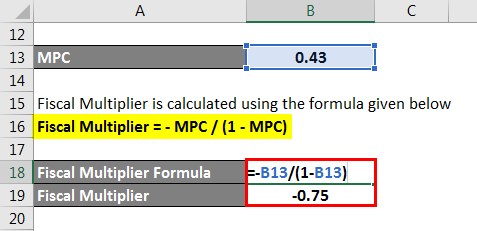

Here we discuss how to calculate the Multiplier Formula along with practical examples. Dual benefits of attractive interest rates and tax saving. Any Exemptions earned by the home are then subtracted from the EAV.

This loan calculator works for flips in Florida Texas California and all 50 states. The lower the number the better. In the case of a member on the TDRL the minimum percentage is 50 while on the TDRL.

Capital Gains Tax Calculator Real Estate 1031 Exchange. Of Current Investments When College Starts was calculated by multiplying your current college savings by a growth index multiplier that corresponds to the selected number of years of possible investing eg. Capital gains losses tax estimator.

Your tax withholdings will depend on a variety of other things such as income marital status dependants and corporate. What will be the tax impact of selling my investment property. The difference between the total interest an individual has to pay on Education Loan minus the total tax rebate an individual can avail on Education Loan under Section 80E of.

Calculation of Equity Multiplier Formula. Know before you invest. What is my tax-equivalent yield.

We also provide a Multiplier calculator with a downloadable excel template. Get tax deduction up to 150000 under Section 80C. In most personal injury cases if an insurance adjuster is using a damages formula like the one in our calculator to value a claim its usually based on a multiplier of between 15 and 5 times the total amount of the claimants medical costs related to the accidentThe number derived from this formula is typically considered an appropriate estimate of the claimants pain and suffering.

New Vacant Home Tax beginning in 2023 homeowners will be required to submit a declaration each year to determine if their property is subject to the new vacant home tax. Compare taxable tax-deferred and tax-free investment growth. The multiplier percentage is at the option of the member who may chose either the percentage of disability assigned or the years of creditable service times 2½.

Gross Rent Multiplier Purchase price divided by the Gross Scheduled Income GSI. Flexible interest pay out monthly quarterly or reinvestment in principal. Please double check that you have the correct values and necessary documentation before submitting to the.

Price Multiplier This number multiplies your cost per candle to give you 1x 2x or 3x return on costs. In this situation youll have to dip into your savings or borrow money to pay your tax bill. The gross rent multiplier GRM approach values a rental property based on the amount of rent an investor can collect each year.

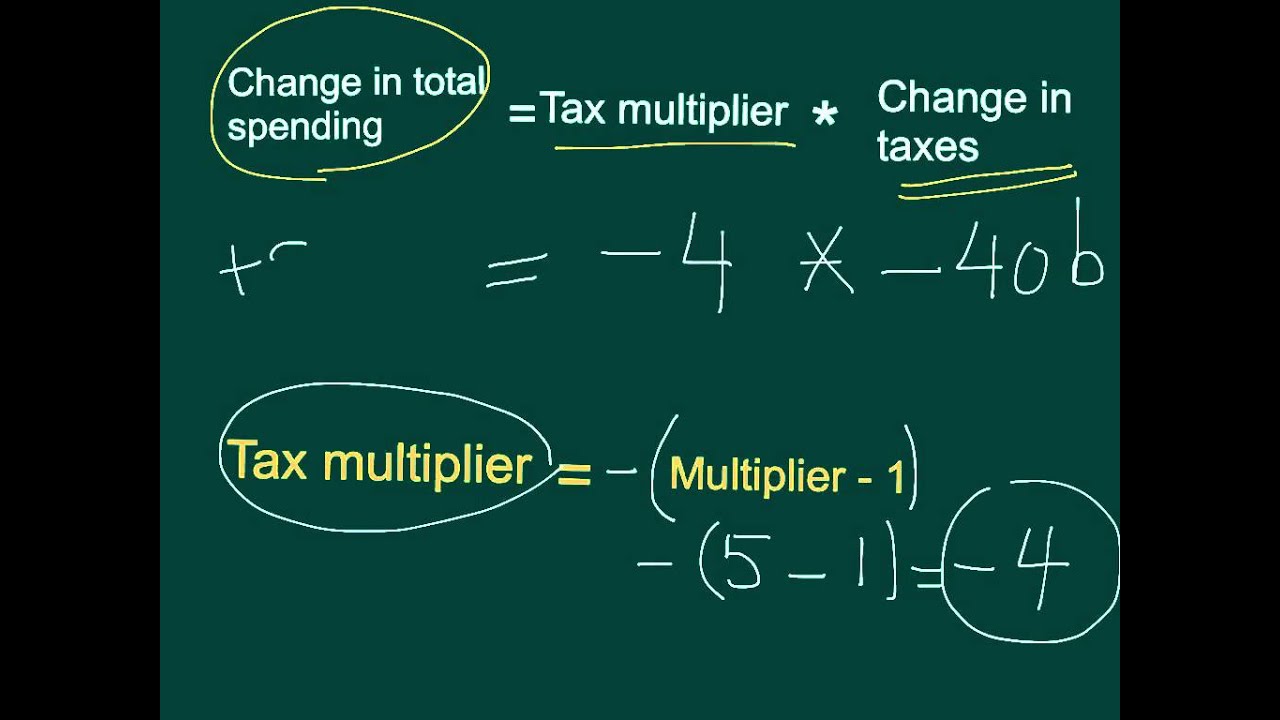

The term tax multiplier refers to the multiple which is the measure of the change witnessed in the Gross Domestic Product GDP of an economy due to change in taxes introduced by its government. You may also look at the following articles to learn more Example of Tax Multiplier Formula. Gross Rent Multiplier is a quick and easy calculation for determining if a property deserves further evaluationGross Rent Multiplier GRM Sale Price Potential Annual Gross IncomeIn general the lower the number the better.

It is a quick and easy way to measure whether a property is worth. Transfer Tax. Minimum investment of 10000 and maximum of 150000 for a duration.

Invest as small as 10000. To put it simply this metric is mostly used by investors economists and governments to study. For disability retirement programs the multiplier will be the higher of a the disability percentage assigned by the Service at retirement not to exceed 75 or b the result of multiplying the number of years of service by the applicable retirement plan multiplier eg 25 for.

Tax Multiplier Simple and Complex The amount that a decrease in taxes will generate in the economy. How much self-employment tax will I pay. This tax incentive provides a State of Arizona income tax deduction for contributions made to any states 529 plan.

Use the standard multiplier if your rateable value is 51000 or more. Use the small business multiplier if your rateable value is below. Receiving a settlement could bump you up to a higher tax bracket and leave you with a much bigger April bill than you usually get.

MyToronto Pay A new way to manage and pay your property taxes and utility bills. This is a guide to Multiplier Formula. The amount of rebate will vary for different tax slabs and can be availed as per Income Tax benefits under Section 80E of Income Tax Act 1961.

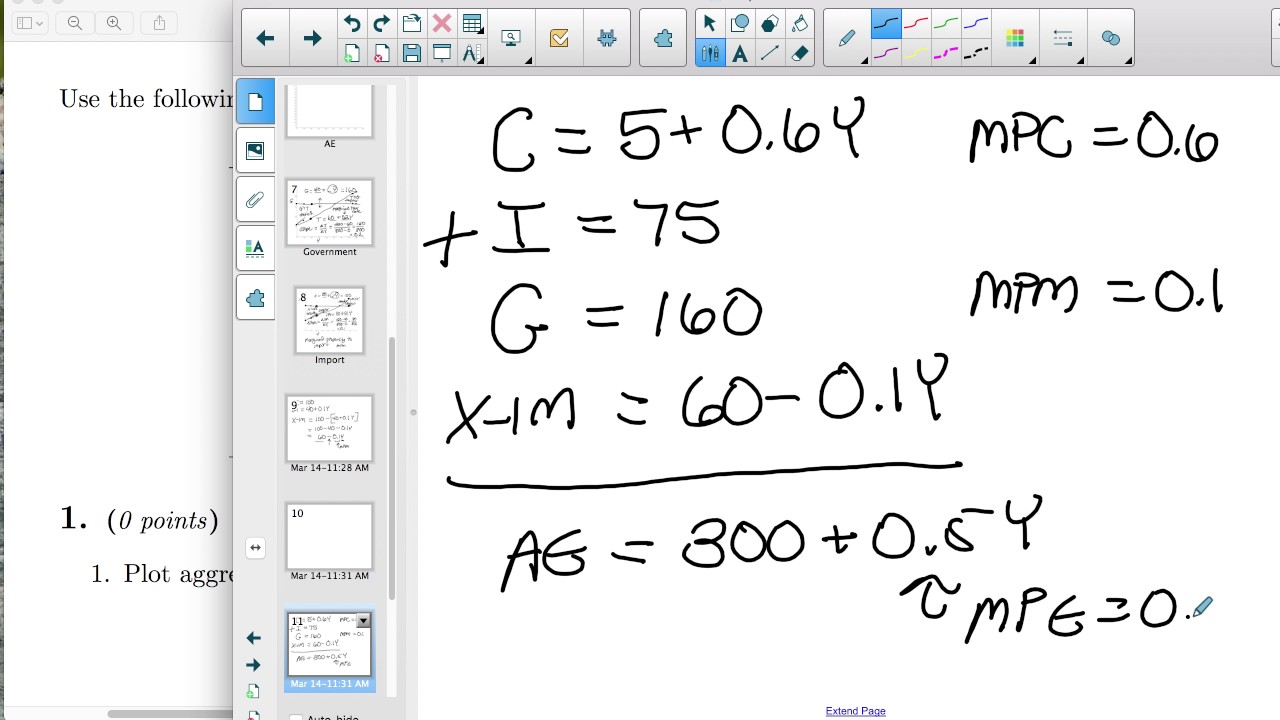

Once those levies are added up the total. Spending Multiplier Save and Consume The expectation of how much activity an investment will make. Effective interest paid.

Then the Tax Rate is applied to the tax levies for your community. What are the tax implications of paying interest. Should I itemize or take the standard deduction.

Tips for Managing Your Taxes.

Contribution Margin Formula And Ratio Calculator Excel Template

Tax Multiplier Effect Definition Formula Video Lesson Transcript Study Com

How To Solve Government Spending Multiplier Problems Youtube

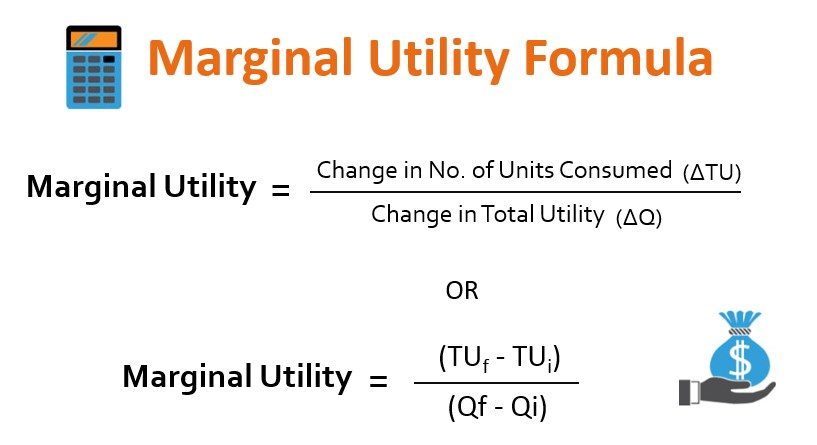

Marginal Utility Formula Calculator Example With Excel Template

Multiplier Formula Calculator Example With Excel Template

Balanced Budget Multiplier Problem Youtube

Section 3 Consumption And The Keynesian Multiplier Inflate Your Mind

Reinvestment Rate Formula And Example Calculator Excel Template

The Multiplier Effect Intelligent Economist

Mpc And Multiplier Video Multipliers Khan Academy

Multiplier Formula Calculate Multiplier Effect In Economics

How To Solve All Kinds Of Tax Multiplier Problems Youtube

Multiplier Formula Calculator Example With Excel Template

Multiplier Formula Calculator Example With Excel Template

Calculating Aggregate Expenditures Youtube

Government Expenditure Multiplier G Multiplier With Diagram

Multiplier Formula Calculate Multiplier Effect In Economics