21+ Calculation Of Surcharge

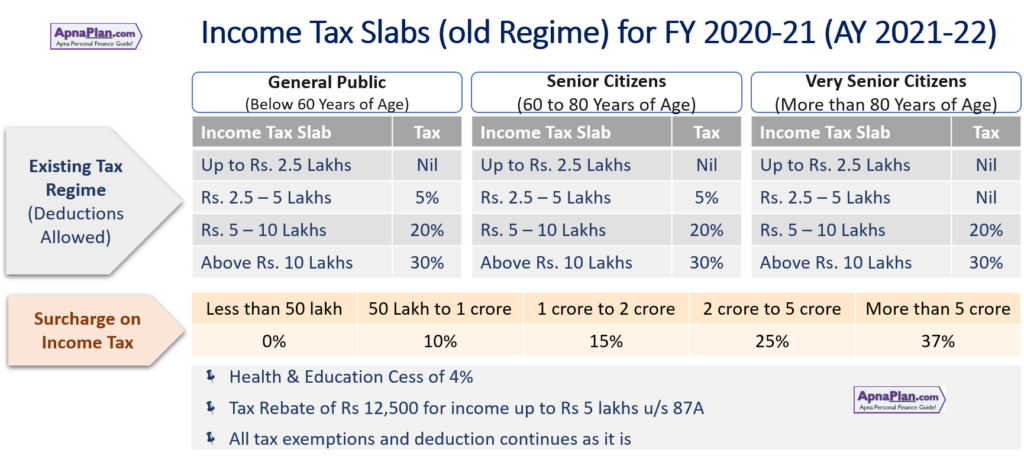

Web Surcharge on income tax is levied if Income is more than Rs. Step 2 Applicable Surcharge 10 Total Tax 1315500 10 1447050.

P C Ratemaking And Loss Reserving By R Brown And L Gottlieb Ppt Download

50 Lakhs in case of Individuals and Rs.

. Web 1 day agoBased on data from the SSA as of December 2022 the 2849908 retired workers receiving benefits at age 67 were taking home 184483 for the month. Medicare prescription drug coverage. How is surcharge calculated on income tax.

Web Surcharge Rate Calculation - Assessment Year 2022-23. 50 Lakhs in case of Individuals and Rs. Web To calculate the surcharge on your income tax follow these steps.

The surcharge rate varies among 10 15 25 and 37. In the Income Tax Act there is a. Step 3 Tax on 50 Lakhs.

Web China on Tuesday kicked off a summit marking the 10th anniversary of its Belt and Road Initiative an ambitious yet controversial undertaking to boost. Web Surcharge is levied on Income Tax and is levied if Income is more than Rs. The enhanced surcharge of 25 37 as.

Web Rate of Surcharge. Web For calculating the surcharge first calculate the income tax which will be 30 of the taxable income amounting to Rs 39 lakh. Last updated on May 8th 2023.

The applicable surcharge rate is. Web Fannie Mae researchers expect prices to increase 67 overall in 2023 and 28 in 2024 while the Mortgage Bankers Association expects a 15 increase in 2023 and a 11. 68680 100 43.

Web 1 day agoPocket Calculator Isnt A Brain Or Magic. Web Youll pay monthly Part B premiums equal to 35 50 65 80 or 85 of the total cost depending on what you report to the IRS. But slide rules take a a little skill to use.

There are 3 steps to calculating the proper surcharge amount. Local authority is taxable at 30. With scale surcharges the.

Web Step 1 Tax on total income Without CESS 1315500. Web Budget 2021. The amount of income-tax shall be increased by.

Web The difference between cess and surcharge is as follows. Income Tax Rates for FY 2020-21 FY 2021-22 for Local Authority. 50 Lakh to 1 Cr.

1 Crores in case of Companies. Eligibility And Types Of Tax Rebates In India. Web 21 Best Tax-Saving Investments in India in April 2023.

1 Crores in case of Companies. The Finance Minister presents the Union Budget every year on 1st February. Determine whether the card type can be surcharged.

Calculating based on scale surcharges. Different rates of surcharge. Web The expected alloy surcharge is then calculated at 29532 using the standard formula.

The cess rate stands fixed at 4. If you predate the pocket calculator you may remember slide rules. Web How do you calculate surcharge amounts.

Assessee type Total Income for PY Calculate. The surcharge is to be calculated in the following manner Suppose Net income of an individual taxpayer is. Calculate your total annual income which includes all earnings from salary property.

Surcharge On Income Tax Fy 2020 21 Ay 2021 22 Financepost

Trucking Careers Critical Supply Solutions

What Is The Surcharge On Income Tax And How Is It Calculated Quora

How To Calculate Surcharges Interpayments

Mutual Funds Taxation Rules Fy 2019 20 Mf Capital Gains Tax Chart

Surcharge Marginal Relief Calculation Individual Huf Aop Boi Ajp

Income Tax Calculator For Fy 2020 21 Ay 2021 22 Excel Download

How To Calculate Surcharge On Income Tax For Ay 2020 21 The Tech Edvocate

Income Tax Surcharge Marginal Relief Calculation Explained With Example Youtube

How To Calculate Surcharge On Income Tax For Ay 2020 21 The Tech Edvocate

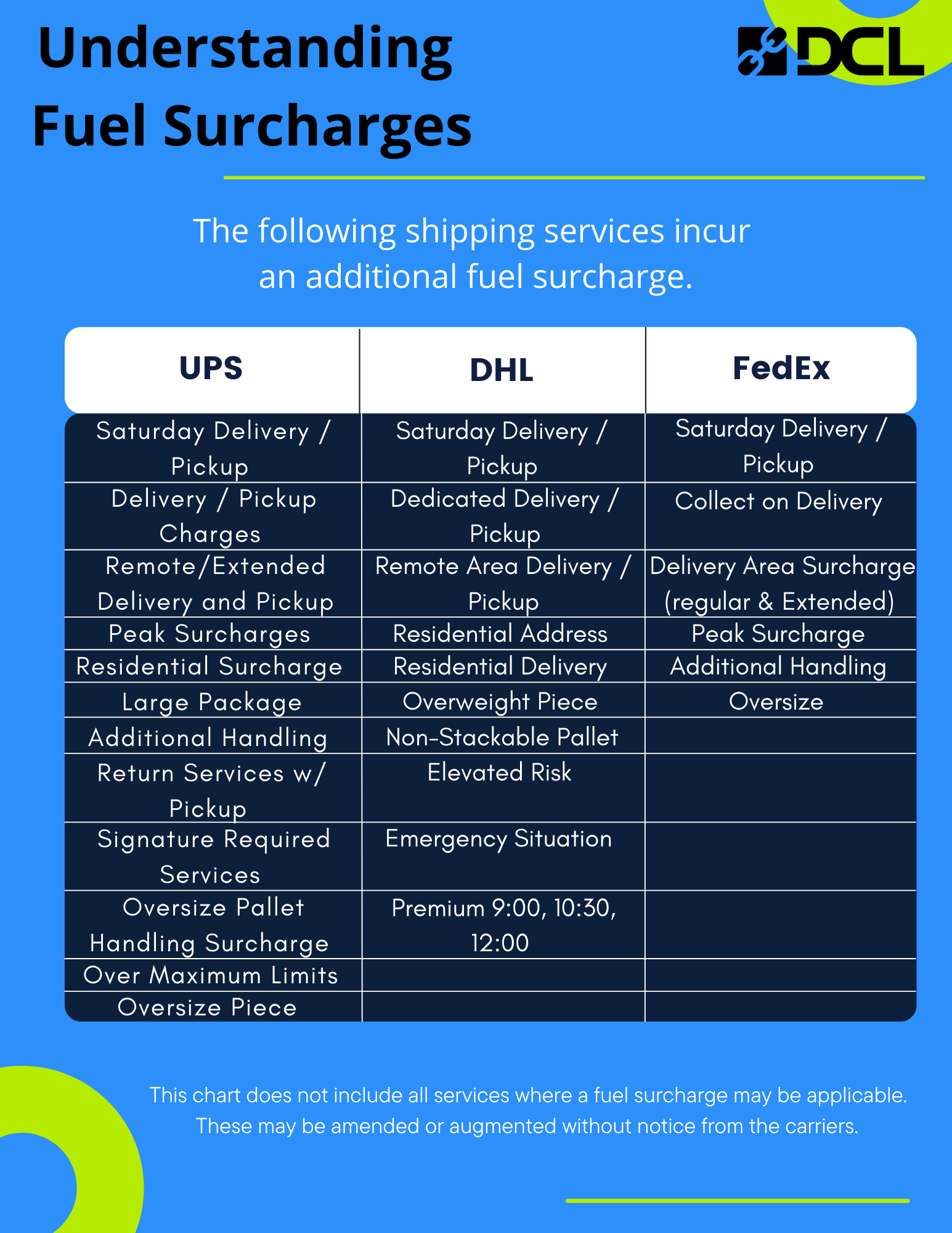

Know Your Freight Costs How To Calculate Fuel Charges Dcl Logistics

Cash Receipt Templates 21 Free Printable Xlsx And Docs Formats Receipt Template Templates Excel Templates

Assess New Surcharge Tax From Equity Gains Mint

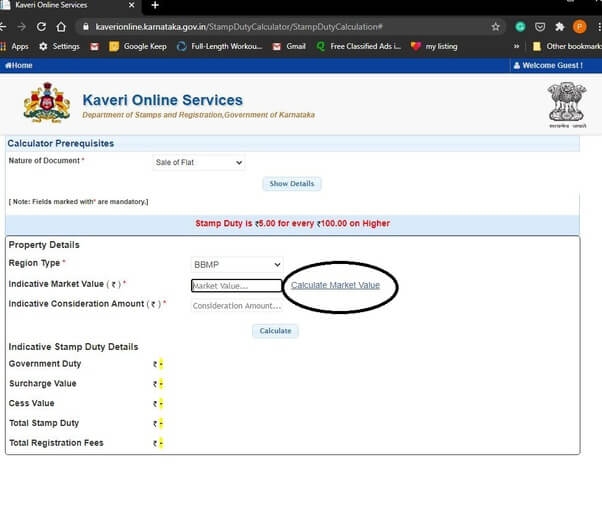

How Do We Calculate The Stamp Duty And Registration Charges Of Property In Bangalore

I Smoke Can A Company Charge Me More For Health Insurance Quora

Age Requirements To Rent A Car In The U S In 2023 By Agency

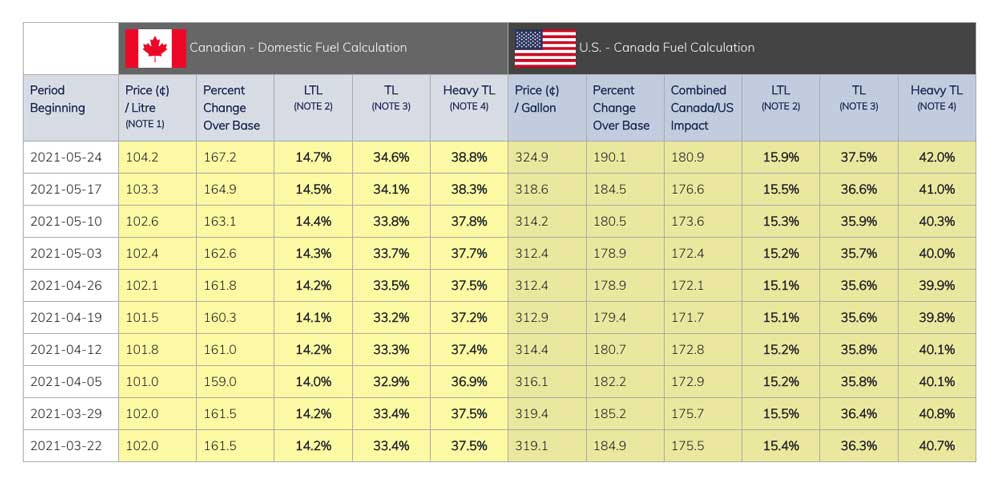

How Does The Fuel Surcharge Work Brimich Logistics